The Power of Compounding:

When it comes to personal finance, one concept often hailed as a game-changer is the power of compounding. But what exactly is compounding, and how can it help you grow your wealth over time? In this blog post, we’ll explore the magic of compounding, how it works, and why even small investments made today can lead to significant financial gains in the future.

What is Compounding?

At its core, compounding is the process where the value of an investment grows exponentially over time, thanks to the earnings generated by both the initial principal and the accumulated interest or dividends. Essentially, it’s earning interest on your interest, leading to a snowball effect that can turn modest investments into substantial sums over the long term.

The Basics of Compounding

To understand compounding, let’s break it down with a simple example. Imagine you invest $1,000 in a savings account that offers an annual interest rate of 5%. At the end of the first year, you’ll earn $50 in interest, bringing your total to $1,050. In the second year, you’ll earn interest not just on your original $1,000, but also on the $50 interest from the first year. This means you’ll earn $52.50 in the second year, bringing your total to $1,102.50. As the years go by, the interest you earn continues to grow, creating a compounding effect.

The Rule of 72

The Rule of 72 is a simple formula that helps you estimate how long it will take for your investment to double, based on a fixed annual rate of return. To use the Rule of 72, divide 72 by your annual interest rate. For example, if you have an investment with an 8% annual return, it will take approximately 9 years (72 ÷ 8 = 9) for your money to double. This rule highlights the importance of higher interest rates and long-term investments in maximizing the power of compounding.

The Importance of Starting Early

One of the key takeaways from the concept of compounding is the importance of starting early. The earlier you begin investing, the more time your money has to grow. Let’s compare two hypothetical investors, Alice and Bob. Alice starts investing $100 per month at age 25, while Bob starts investing the same amount at age 35. Assuming an annual return of 7%, Alice will have approximately $382,848 by the time she reaches 65, while Bob will have about $188,665. Despite both contributing the same amount per month, Alice’s earlier start allows her to benefit significantly more from compounding.

The Impact of Regular Contributions

Regular contributions to your investment portfolio can significantly enhance the power of compounding. By consistently adding to your investments, you increase the principal amount that earns interest, accelerating the growth of your wealth. For instance, if you invest $200 per month in a retirement account with an average annual return of 6%, you’ll accumulate over $185,000 in 30 years. Regular contributions, even if they seem small, can lead to substantial financial gains over time.

Compounding in Different Investment Vehicles

Compounding isn’t limited to savings accounts. Various investment vehicles can harness the power of compounding to grow your wealth. Here are a few examples:

- Stocks: Investing in stocks allows you to benefit from both capital appreciation and dividends. Reinvesting dividends can significantly boost the compounding effect, leading to higher returns over the long term.

- Bonds: Bonds provide fixed interest payments, which can be reinvested to take advantage of compounding. While bonds typically offer lower returns than stocks, they can still play a valuable role in a diversified investment portfolio.

- Mutual Funds and ETFs: Mutual funds and exchange-traded funds (ETFs) pool investors’ money to invest in a diversified portfolio of assets. Reinvesting dividends and capital gains within these funds can enhance the compounding effect.

- Retirement Accounts: Tax-advantaged retirement accounts like 401(k)s and IRAs are excellent vehicles for long-term investments. The tax benefits and compounding growth within these accounts can help you build a substantial nest egg for retirement.

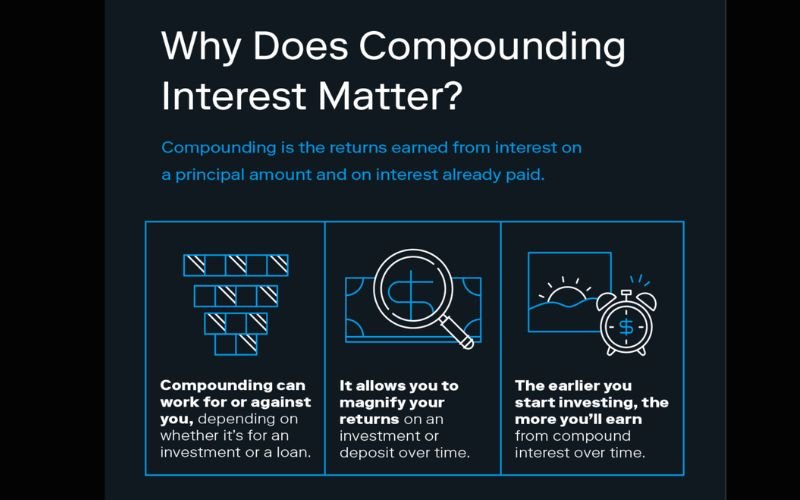

The Role of Compound Interest in Debt

While compounding is a powerful tool for growing your wealth, it can also work against you when it comes to debt. Credit card debt, student loans, and other forms of borrowing often come with compound interest, meaning you pay interest on both the principal amount and the accumulated interest. This can lead to a significant increase in the total amount you owe over time. To avoid the negative effects of compound interest, it’s essential to pay off high-interest debt as quickly as possible and avoid carrying a balance on credit cards.

Strategies to Maximize Compounding

To make the most of compounding, consider implementing the following strategies:

- Start Early: The sooner you begin investing, the more time your money has to grow. Even small contributions made early on can lead to substantial gains over the long term.

- Invest Regularly: Consistent contributions to your investment portfolio can accelerate the compounding effect. Set up automatic transfers to ensure you invest regularly, regardless of market conditions.

- Reinvest Earnings: Reinvesting dividends, interest, and capital gains can significantly enhance the compounding effect. Many investment platforms offer automatic reinvestment options to make this process seamless.

- Diversify Your Portfolio: Diversifying your investments across different asset classes can help you manage risk and take advantage of compounding in various markets. A well-balanced portfolio can provide more consistent returns over time.

- Take Advantage of Tax-Advantaged Accounts: Maximize contributions to retirement accounts and other tax-advantaged accounts to benefit from compounding growth and tax savings. These accounts can help you build wealth more efficiently.

Conclusion

The power of compounding is a fundamental concept in personal finance that can help you grow your wealth over time. By starting early, making regular contributions, reinvesting earnings, and diversifying your investments, you can harness the magic of compounding to achieve your financial goals. Remember, even small investments made today can lead to significant financial gains in the future. So, take advantage of the power of compounding and set yourself on the path to financial success.